This post is the second in a series analyzing proposals that seek to change provisions in the Affordable Care Act.

First post: The Ramifications of Repealing the Individual Mandate

The Affordable Care Act (ACA) requires that health insurers make coverage accessible and affordable to all individuals, regardless of age, gender, or health status. Under the ACA, people age 64 and older cannot be charged more than three times as much as 21- to 24-year-olds for the same plan (this is known as 3-to-1 “rate banding”). In general, this rule reduces premiums for older enrollees, while raising costs for younger enrollees. While the goal of the regulation is to make insurance affordable for all age groups, critics argue that it discourages young, healthy people from enrolling.

Several recent proposals, including one offered by Senators Richard Burr (R-N.C.), Orrin Hatch (R-Utah), and Rep. Fred Upton (R-Mich.), would allow insurers to charge older adults up to five times as much as younger adults (5-to-1 rate banding) while simultaneously making other changes to the ACA. We analyzed the effects of relaxing the ACA’s rate bands from 3-to-1 to 5-to-1 while leaving other ACA provisions in place. We focused on marketplace plans and other ACA-compliant health plans in the individual market, and excluded plans offered by employers (which are regulated differently). We found that while more—mostly younger—people would become insured under 5-to-1 rate banding, federal health spending would increase and 400,000 older people, who tend to have more health problems, would lose coverage.

We conducted our analysis using the RAND COMPARE microsimulation model, a tool that uses economic theory and data to predict how individuals and employers will respond to the ACA. Our technical appendix describes the model approach and methods in detail.

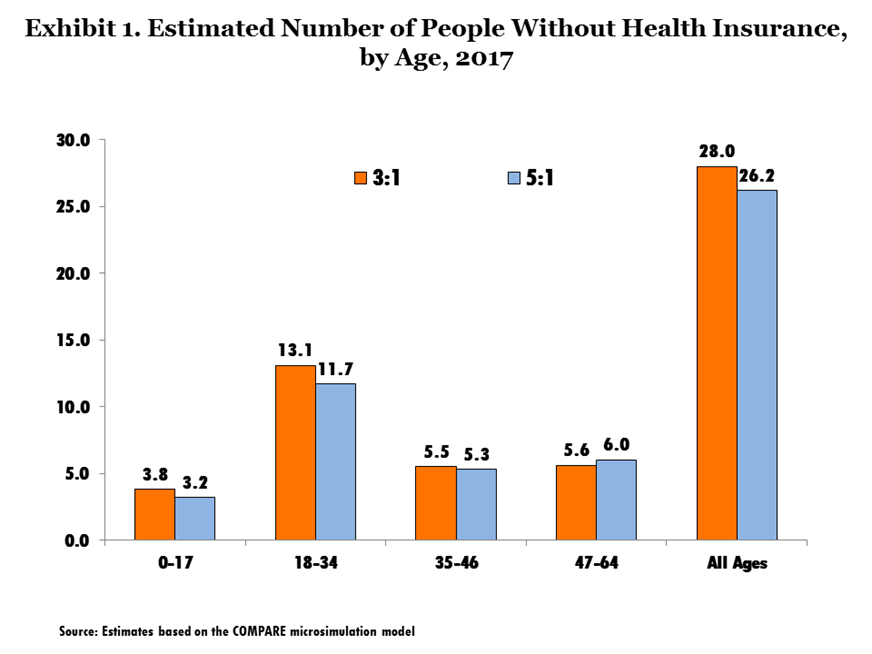

Simulations using the COMPARE model suggest that, with 5-to-1 rate banding, people age 47 and older would face higher premiums than they would under 3-to-1 rate banding, while people under age 47 would benefit from lower premiums. For example, a benchmark annual premium for a 64-year-old would rise from about $8,500 under the ACA to $11,000 under 5-to-1 rate banding. In contrast, the annual premium for a 21-year-old would fall by about $700, from $2,800 to $2,100. As a result, our modeling finds that a net 1.8 million additional people would be insured with 5-to-1 rate banding relative to 3-to-1 rate banding (Exhibit 1). However, this change—a 6 percent decrease in the number of uninsured—comes with a hefty price tag, because many of the older adults facing higher premiums would surpass the ACA’s premium contribution cap. Because the young people who would newly enroll would be mostly ineligible for subsidies, the increase in federal spending on older adults would more than offset any federal savings stemming from new enrollment among young people. We estimate that total federal spending would increase by $9.3 billion as a result of the rate-banding change.

To fully understand the shifts in spending and the number of insured, it is helpful to consider how changes in coverage vary across age and income groups. Relaxing the rate bands results in 4.4 million people under the age of 47 newly enrolling in the individual market. The vast majority of these people (88 percent) have incomes too high to enable them to qualify for subsidies. In addition, more than 40 percent of these new enrollees shift from employer coverage into the individual market, rather than becoming newly insured. About 75 percent of those who are estimated to shift from employer to individual market are under age 20 and enrolled on their parents’ plans. (Families would save money by moving a child or children to the individual market.) Meanwhile, a net 400,000 people over age 47 lose coverage when the rate bands are relaxed from 3-to-1 to 5-to-1, because these older individuals face higher marketplace premiums and have no alternative source of coverage. Most of those losing coverage are unsubsidized as well. Overall, younger, unsubsidized people benefit from the change, while older people face higher premiums.

While few new enrollees receive subsidies, federal spending increases under 5-to-1 rate banding because subsidy spending increases for existing enrollees. This increase in spending occurs because the ACA caps premium contributions for low- and moderate-income marketplace enrollees as a percent of income. If the premium exceeds the cap, the federal government pays the difference, as long as the enrollee chooses a benchmark plan or cheaper coverage. Older adults are more likely to hit the contribution cap than younger adults because, although premiums increase with age, the cap remains fixed. Because many older enrollees already hit the cap under 3-to-1 rate banding, the increase in premiums caused by 5-to-1 rate banding would be financed primarily by the federal government.

Simultaneously, revenue from the ACA’s individual mandate penalty declines with 5-to-1 rate banding, because more people become insured. Overall, annual federal costs associated with the ACA would increase by $9.3 billion dollars if rate bands were relaxed from 3-to-1 to 5-to-1 (Exhibit 2).

Exhibit 2. Annual Federal Budgetary Effects of Relaxing ACA’s Rate Bands from 3-to-1 to 5-to-1, 2017

|

Budget Outcome

|

Net Effect on Cost of ACA (in $ billions)

|

| Spending on subsidies | $8.3 |

| Loss of individual mandate revenue | $1.0 |

| Total change in spending | $9.3 |

Source: Estimates based on the RAND COMPARE microsimulation model.

Should policymakers wish to encourage enrollment among the young and healthy, 5-to-1 rate banding may not be a cost-effective solution, given that federal spending for existing older enrollees would likely increase and the need for charity care among vulnerable older adults would rise. Other approaches, such as expanding outreach to younger enrollees, educating consumers about the benefits of insurance, and improving the functionality of marketplace websites to make it easier to enroll, could yield higher enrollment at a lower cost to taxpayers.