Overview

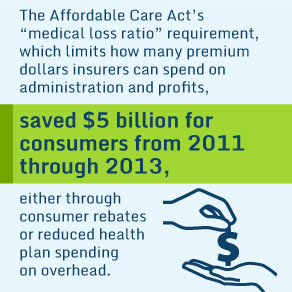

For the past three years, the Affordable Care Act has required health

insurers to pay out a minimum percentage of premiums in medical claims or

quality improvement  expenses—known as a medical loss ratio (MLR). Insurers

with MLRs below the minimum must rebate the difference to consumers. This

issue brief finds that total rebates for 2013 were $325 million, less than one-third

the amount paid out in 2011, indicating much greater compliance with the MLR

rule. Insurers’ spending on quality improvement remained low, at less than 1

percent of premiums. Insurers’ administrative and sales costs, such as brokers’

fees, and profit margins have reduced slightly but remain fairly steady. In the

first three years under this regulation, total consumer benefits related to the

medical loss ratio—both rebates and reduced overhead—amounted to over $5

billion. This was achieved without a great exodus of insurers from the market.

expenses—known as a medical loss ratio (MLR). Insurers

with MLRs below the minimum must rebate the difference to consumers. This

issue brief finds that total rebates for 2013 were $325 million, less than one-third

the amount paid out in 2011, indicating much greater compliance with the MLR

rule. Insurers’ spending on quality improvement remained low, at less than 1

percent of premiums. Insurers’ administrative and sales costs, such as brokers’

fees, and profit margins have reduced slightly but remain fairly steady. In the

first three years under this regulation, total consumer benefits related to the

medical loss ratio—both rebates and reduced overhead—amounted to over $5

billion. This was achieved without a great exodus of insurers from the market.