July 26, 2016—This blog post has been slightly revised to clarify that the Mercatus Center report excluded reinsurance, risk adjustment, and risk corridor payments only from its calculation of medical loss ratios but did separately discuss payments under these programs.

Critiques of the Affordable Care Act (ACA) increasingly focus on health insurers that have struggled financially, but these reports are often anecdotal or limited—addressing only a single or a few insurers. Recently, however, data have become available that allow a full assessment of insurers’ financial performance during 2014, the ACA’s first year of full market reforms.

Using these new data in an issue brief published by The Commonwealth Fund today, we found that, overall, health insurers’ operating profits in 2014 from selling insurance (not including profits from investments) were 1 percent of premiums, or $3.7 billion. In previous years, overall operating profits ranged from 2.5 to 3 percent, or $8 billion to $9 billion. A portion of the drop in profits was caused by increased losses in the individual market, which averaged -4.2 percent, or $2.5 billion, compared with -3.1 percent or $1 billion loss the prior year.

As others have observed, these losses in the individual market in 2014 resulted from insurers pricing their products too low relative to the medical costs that enrollees ultimately incurred. The ACA fundamentally transformed the market for individual insurance with its premium subsidies and new consumer-oriented market rules. Actuaries lacked sufficient experience to predict medical claims accurately, and insurers’ competitive desire for new enrollees led many of them to price their policies aggressively, which resulted in an overall medical loss ratio of 89.4 percent in the individual market, about 4 percent higher than in prior years. (The “medical loss ratio” is the percent of premiums devoted to medical claims rather than to overhead costs or profits.)

The designers of the ACA anticipated these transitional difficulties, however, and so included three premium stabilization programs, known as the “3-Rs,” for reinsurance, risk adjustment, and risk corridors. Especially important was reinsurance, which reimbursed insurers in the individual market for a portion of the medical claims from higher-cost patients. Even though medical claims for ACA-compliant policies were on average 5.6 percent higher than insurers initially projected when they set their premiums, much of the excess cost was offset by reinsurance payments of $8 billion. These reinsurance payments lowered the cost overrun to a net 2.4 percent of medical claims.

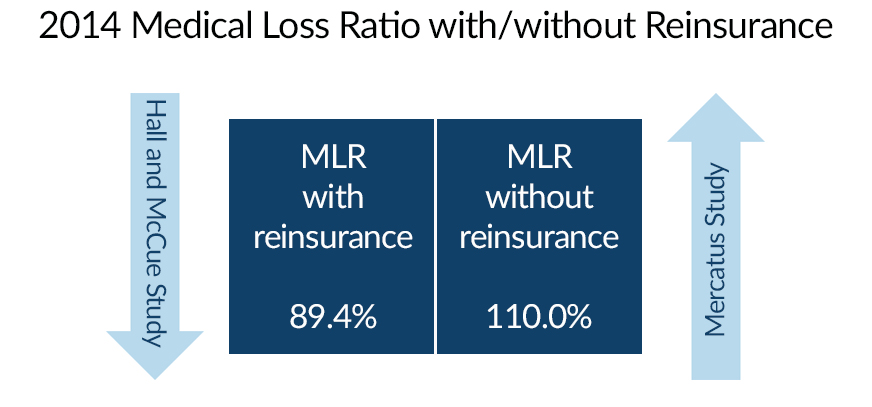

Obviously, then, accounting for the ACA’s reinsurance and other loss-mitigation components is critical in evaluating its full financial effects. To illustrate, in contrast with our analysis, a recent report by the Mercatus Center at George Mason University reported a medical loss ratio of 110 percent for ACA-compliant policies sold in 2014 by health insurers participating in the new insurance marketplaces (including those policies they sold outside the exchanges). A 110 percent loss ratio would mean that medical claims exceeded premiums by 10 percent. However, in calculating medical loss ratios, the Mercatus calculation purposefully excludes reinsurance and risk corridor payments received by insurers. Including those, and using Mercatus’s own numbers and formula, the medical loss ratio for their sample of insurers drops to 89.6 percent—almost precisely the 89.4 percent that we found for the individual market as a whole (including both ACA-compliant and non-compliant grandfathered and transitional plans).

Mercatus excluded reinsurance and risk corridor payments in calculating medical loss ratios in order to highlight how poorly the market would function without these premium stabilization mechanisms. But those mechanisms are part of the ACA’s full package of reforms, and insurers took them into account in setting their premiums. Therefore, reporting these payments separately is not an accurate indicator of how the ACA’s market rules are functioning as a whole.

The same set of premium stabilization mechanisms are also part of Medicare’s Part D program for prescription drug coverage, which was crafted during the George W. Bush administration. Reinsurance in particular remains a key part of the Medicare Part D’s success at keeping premiums affordable. Under Medicare’s market rules, reinsurance accounts for about half of prescription drug costs. Thus, if reinsurance payments were excluded from a loss ratio calculation there, as Mercatus did in evaluating the ACA, Part D insurers would falsely appear to have medical loss ratios approaching 200 percent.

For both Medicare Part D and for the ACA, reinsurance plays a crucial rule in transitioning to new market conditions. Indeed, for Medicare Part D, reinsurance is not merely transitional as it is for the ACA; it remains a permanent feature. Under the ACA, reinsurance is slated to expire in 2017. But, because full transition has taken longer than initially expected, there is good reason to consider extending the ACA’s reinsurance program until the reformed market has matured.