The Commonwealth Fund is committed to transparency. We share regularly updated information about our grantmaking as well as current demographic data on our staff, directors, grantees, and fellows. Our commitment to transparency is also evident in our financial disclosures; the Fund holds itself accountable for using resources responsibly and conducting its operations efficiently.

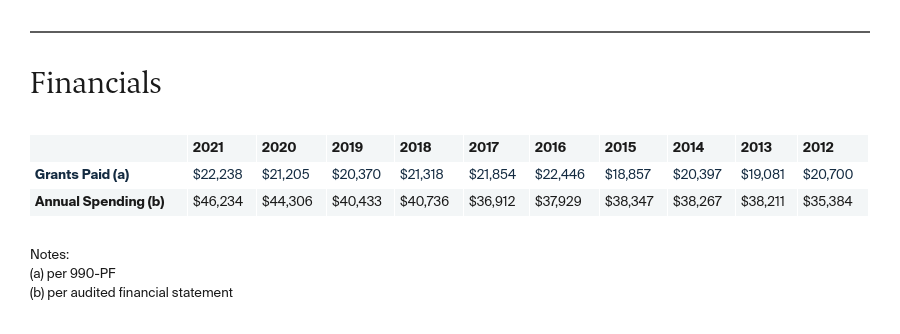

The two most commonly used financial reports for a private foundation are the audited financial statements and the 990-PF — the IRS return filed by private foundations. We provide each report as it is finalized, as well as a document that summarizes and explains key sections of the 990-PF.

Our Approach to Adding Value

How the Commonwealth Fund carries out its work is a reflection of its history and its commitment to stay abreast of developments related to health care, technological change, workforce patterns, and the financial and economic environment. Our research programs address areas of health care policy and practice where we believe we can have the greatest impact, whether through grantmaking or through staff-conducted research and communications activities.

The Fund’s approach to value-added grantmaking reflects our philosophy that when grantees and foundation staff work together closely, and when there are processes in place to monitor, evaluate, and glean lessons, we enhance the potential of our work to effect positive change. For example, the Fund’s internal research and evaluation team produces knowledge and information to enrich the health policy field and complement the work of our grantees. Fund staff directly manage some longstanding programs, including the Harkness Fellowships in Health Care Policy and Practice, to enhance their effectiveness and ensure continuity. And our communications team collaborates closely with program staff and grantees to disseminate and publicize research findings, including through a wide variety of publications and other content posted on the Fund’s website as well as strategic communications plans and targeted media outreach.

2023

2022

2021

2020

2019

2018

2017

Investments

The primary objective of the Commonwealth Fund’s investment strategy is to preserve and grow our endowment in perpetuity by making investments that generate returns in excess of our total spending.

The Investment Committee of the Fund’s Board of Directors is charged with oversight of the investment portfolio. The Fund’s endowment is managed through an outsourced chief investment officer, or OCIO. The Fund chose Agility as its OCIO in 2016 based on the firm’s demonstrated ability and commitment to incorporate greater mission alignment into portfolio management without sacrificing investment returns.

Mission-Aligned Investment Strategies

The Commonwealth Fund has taken several key steps over the past years to align its investment approach with programmatic activities, the impact of which we continue to monitor and track. These steps include:

- Partnering with our OCIO, Agility, to develop and implement an investment policy statement that incorporates higher levels of environmental, social, and governance considerations into portfolio management, as well as divestment strategies from industries considered antithetical to the Fund’s mission (2017)

- Excluding from our investment portfolio all companies that manufacture tobacco products and/or grow or process raw tobacco leaves, including e-cigarettes (2017)

- Excluding investments in companies that manufacture firearms and small-arms ammunition for civilian markets (2018)

- Implementing a plan to reduce fossil fuel investments, with a goal of reducing these to zero through immediate divestment in liquid assets and continued exposure reduction in all asset classes as soon as feasible (2022).

Inclusive Investment Management Practices

In 2019, the Commonwealth Fund began to explore opportunities to align endowment management more closely with the foundation’s commitment to antiracism, diversity, and inclusion. Through discussions with staff and board members and findings from a demographic manager survey fielded by Agility, we learned that racially diverse and female-owned investment firms were underrepresented in our portfolio, just as they were across the entire investment industry. This was a disappointing finding, as research shows that the performance of funds led by people of color or women and funds led by others is statistically indistinguishable. In response, the Fund has taken the following steps to build more inclusive investment management practices:

- In early 2022, the Investment Committee and the Board established long- and short-term gender and racial diversity goals for our fund managers, an effort that falls under the Fund’s Leadership and Equity Action Plan, or LEAP. The LEAP initiative has set specific goals around gender, racial, and ethnic diversity in the portfolio manager group as measured by ownership and leadership, with a particular focus on underrepresented racial and ethnic groups.

- Signed the Association of Black Foundation Executives’ Investment Manager Diversity Pledge and continue to explore opportunities to support the group’s efforts to expand the reach and influence of the pledge.

- Committed to transparency about the gender and racial diversity of our investment manager teams by sharing key results from an annual independent survey of Agility’s client portfolios. The baseline year for this survey is 2021, and the Fund intends to publish its results annually. Our hope is that these efforts will contribute to the field of philanthropy’s shift toward more inclusive investment management practices.

Please contact Agility with questions about the Commonwealth Fund’s investment portfolio and strategy.