Abstract

Across the country’s four largest states, uninsured rates vary for adults ages 19 to 64: 12 percent of New Yorkers, 17 percent of Californians, 21 percent of Floridians, and 30 percent of Texans lacked health coverage in 2014. Differences also extend to the proportion of residents reporting problems getting needed care because of cost, which was significantly lower in New York and California compared with Florida and Texas. Similarly, lower percentages of New Yorkers and Californians reported having a medical bill problem in the past 12 months or having accrued medical debt compared with Floridians and Texans. These differences stem from a variety of factors, including whether states have expanded eligibility for Medicaid, the state’s uninsured rate prior to the Affordable Care Act taking effect, differences in the cost protections provided by private health insurance, and demographics.

OVERVIEW

The Affordable Care Act has had profound implications for health insurance coverage in the United States. More than 25 million Americans now have coverage under its provisions, which include the expansion of Medicaid eligibility, subsidized private plans purchased in the health insurance marketplaces, and—for young adults up to age 26—the opportunity to enroll in a parent’s plan.1 A recent analysis of the Commonwealth Fund Biennial Health Insurance Survey indicates that the percentage of uninsured adults has dropped from 20 percent in 2010 to 16 percent in 2014.2 The law, however, gives states flexibility in implementing its provisions, including the choice of operating their own health insurance marketplace or leaving that task to the federal government. Moreover, in 2012, the U.S. Supreme Court gave states the power to decide whether or not to expand Medicaid eligibility to more lower-income adults. States’ policy choices, combined with each state’s unique demographic characteristics and history, have resulted in a wide range of experiences among Americans since the law took effect. In this brief we use data from the Biennial Survey to examine differences in health insurance coverage, cost-related problems getting needed care, and medical bill problems and debt among adults ages 19 to 64 in the nation’s four largest states.

The four largest states in the U.S.—California, Florida, New York, and Texas—fall into two distinct categories. The first group is represented by California and New York, both of which are operating their own health insurance marketplaces and have expanded eligibility for Medicaid to adults who earn at or below 138 percent of the federal poverty level—about $16,000 for an individual or $32,000 for a family of four.3 Florida and Texas, the second group, are using the federal marketplace to enroll residents in health plans and have declined to expand Medicaid eligibility. In this new analysis of data from the Commonwealth Fund Biennial Health Insurance Survey, we find that, in 2014, there were larger shares of uninsured adults in Florida and Texas compared with California and New York. In addition, adults in Florida and Texas were more likely to report not getting needed care because of cost and to report having problems paying medical bills.

SURVEY FINDINGS IN DETAIL

Texas Has Highest Uninsured Rate of the Four Largest States

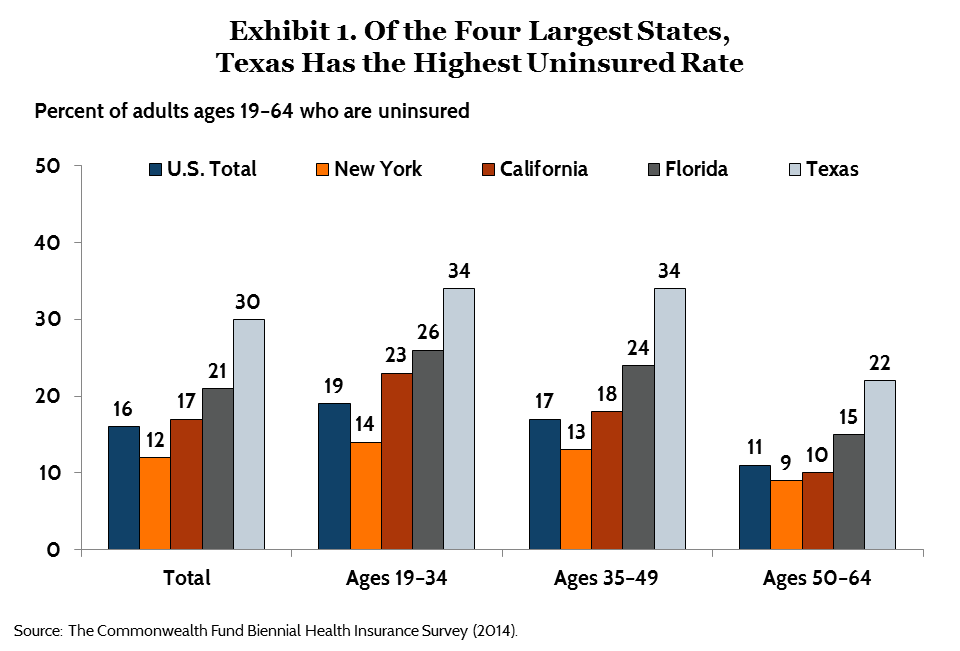

Among the four states, the proportion of working-age adults without health coverage in 2014 was highest in Florida and Texas, at 21 percent and 30 percent, respectively (Exhibit 1). California’s uninsured rate was 17 percent, while New York’s was 12 percent.4,5,6 While this study did not examine trends at the state level, federal survey data indicate that since the Affordable Care Act’s passage, uninsured rates declined in all four states, with California registering the greatest decrease.7

Young adults have experienced the largest gains in coverage nationally. According to the survey, by 2014, the national uninsured rate for 19-to-34-year-olds was 19 percent. This was down from 27 percent in 2010, the year adult children became eligible to remain on parents’ health plans to age 26.8 There are differences among the four states. In New York, 14 percent of young adults were uninsured in 2014, compared with 34 percent in Texas, 26 percent in Florida, and 23 percent in California.

| How Florida and Texas Are Implementing the Affordable Care Act Neither Florida nor Texas has expanded eligibility for Medicaid under the Affordable Care Act. Both states opted to use the federal marketplace, HealthCare.gov, to enroll individuals in private plans. For their existing Medicaid programs, both states have very low income eligibility thresholds. In Florida, adults who are parents of dependent children are eligible for Medicaid if they make less than 34 percent of the poverty level—an annual income of about $8,000 for a family of four—but there is no coverage for childless adults.9 There is also no Medicaid coverage for childless adults in Texas and the eligibility threshold for parents is even lower at 19 percent of poverty, or an annual income of about $4,475 for a family of four.10 Both Florida and Texas have had successful enrollment in their marketplaces: about 1.6 million people have selected a 2015 marketplace plan in Florida and more than 1.2 million have done so in Texas.11 Both states have also seen increases in their Medicaid enrollment since October 2013, as more people have become aware that they are eligible for coverage: Florida’s Medicaid and Children’s Health Insurance Program enrollment has grown by about 300,000 people and Texas’ enrollment has grown by about 210,000.12 |

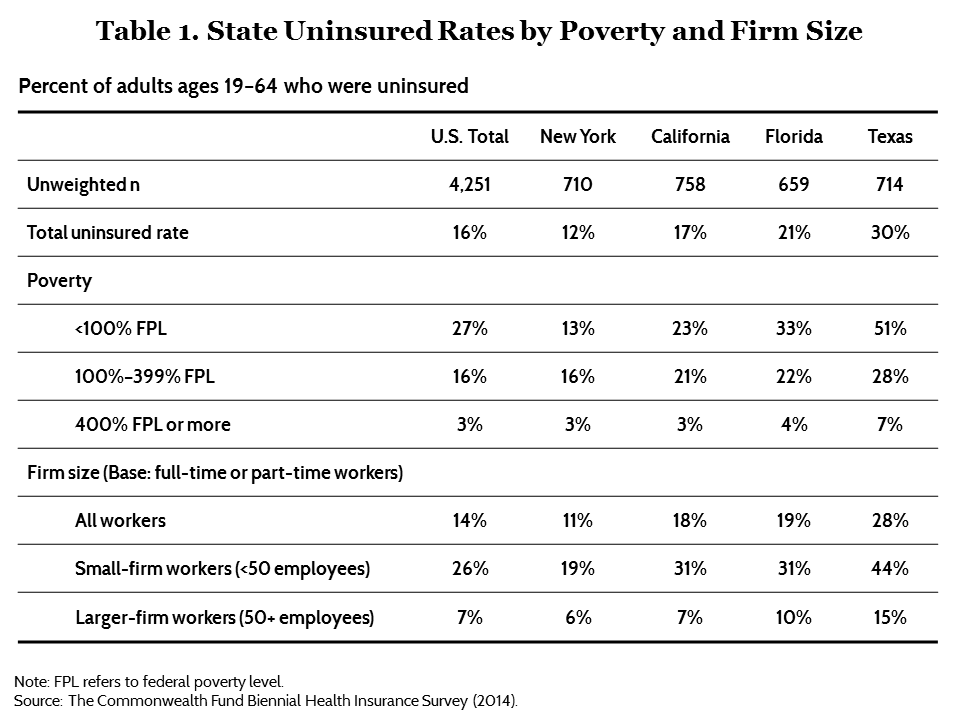

There are also significant differences in coverage rates for adults with low incomes. Adults with incomes below 100 percent of the federal poverty level—that is, $11,490 for an individual or $23,550 for a family of four—are faring best in New York and California (Table 1). Thirteen percent of low-income New Yorkers and 23 percent of low-income Californians are uninsured, compared with 33 percent of low-income adults in Florida and 51 percent in Texas. Even before the passage of the Affordable Care Act, both New York and California had established Medicaid eligibility levels that were more generous than most states. And under the health reform law, both states expanded eligibility for Medicaid up to 138 percent of poverty, while Florida and Texas did not.

In addition to policy decisions, demographics also likely contribute to differences in insurance coverage rates, although they do not explain the state differences completely. For example, undocumented immigrants are ineligible for subsidized coverage or Medicaid under the law. In Texas, adults below 100 percent of poverty are much more likely to be foreign-born than are adults with incomes between 100 percent and 399 percent of poverty (35% vs. 26%) (data not shown). People born outside the United States but who reside here now are much more likely to be uninsured than those born in the U.S. (31% vs. 12%) (data not shown).13

New York and California: Lower Rates of Problems in Getting Needed Health Care Because of Cost

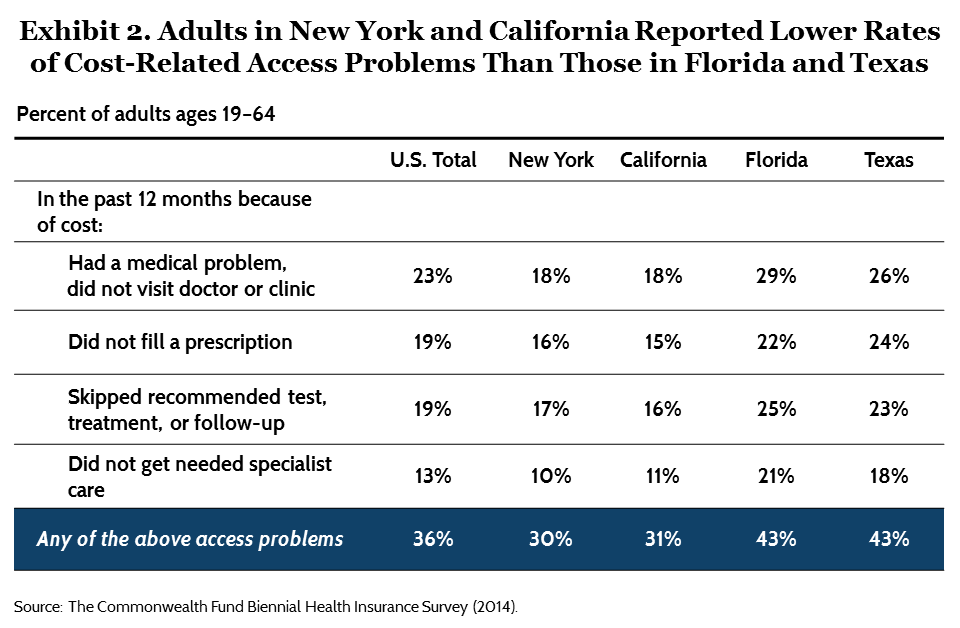

Across the country, expanded insurance coverage is helping people get the care they need by reducing financial barriers to care. The survey asked adults about delaying or skipping needed care because of cost in the past 12 months. About three of 10 New Yorkers (30%) and Californians (31%) reported having at least one cost-related access problem, compared with 43 percent of Floridians and Texans (Exhibit 2).14 These differences remain statistically significant even after taking into account the states’ demographic profiles.

There was variation between states in all four cost-related areas asked about in the survey. In New York and California, 18 percent of residents reported having a medical problem but not going to a doctor or clinic because of cost, versus 29 percent in Florida and 26 percent in Texas. Residents in New York and California reported not getting needed specialist care at about half the rate as people in Florida and Texas.

There are likely a range of factors contributing to this variation, with insurance coverage playing a large role. Across the U.S., insured adults have historically reported cost-related access problems at much lower rates than uninsured adults.15 To some degree, California and New York’s higher rates of coverage likely translate into lower rates of reported problems. But the quality of health insurance coverage—particularly, how much people have to pay out-of-pocket relative to their income—also makes a difference. Insured adults in New York (27%) and California (28%) reported lower rates of problems getting needed care in the past 12 months than did insured adults in Texas (36%) and Florida (39%) (data not shown). These differences persisted across the income distribution. One factor may be deductibles and other cost-sharing aspects of people’s insurance policies. Research has shown that people with high deductibles relative to their income are much more likely to report not getting needed care because of cost than those with lower deductibles.16 The survey found that a smaller share of insured Californians and New Yorkers (9 percent and 7 percent, respectively) had deductibles that were 5 percent or more of their income compared with Texans (18%) and Floridians (17%) (data not shown). Moreover, a recent analysis of federal data found that more people have health plans with deductibles in Florida and Texas: in 2013, 62 percent of employees with single-person insurance plans in New York and California had a deductible, compared with 84 percent in Florida and 90 percent in Texas.17

| How New York and California Are Implementing the Affordable Care Act California was the first state to pass legislation to establish a state-based marketplace. The marketplace is an active purchaser, meaning it evaluates proposed plans based on factors like affordability and access to high-quality care, and may choose to limit the number of plans offered.18 The state also has a long history of setting more generous eligibility levels for Medicaid coverage than federal mandates and does not require a five-year waiting period for legal immigrants to be eligible for coverage, although the state pays all the costs of providing care for this population. The state also created the Low Income Health Program under a Section 1115 waiver, which provided coverage to adults under 200 percent of poverty in participating counties from July 2011 to December 2013.19 After that, 650,000 enrollees transitioned into the state’s expanded Medicaid program and more than 25,000 people purchased private plans offered through the state’s marketplace, Covered California.20 In the past year more than 1.4 million people have selected private plans through Covered California for 2015; more than 3 million individuals have gained Medicaid coverage since October 2013.21 New York has also expanded eligibility for Medicaid and is operating its own marketplace, the New York State of Health. New York has had more generous Medicaid eligibility levels than many states since it passed the Health Care Reform Act of 2000, well before national health reform was passed. The state’s Family Health Plus program expanded Medicaid eligibility to parents with incomes up to 150 percent of poverty and childless adults up to 100 percent of the poverty level.22 New York’s Medicaid program does not require a five-year waiting period for legal immigrants to be eligible for coverage, although the state does not receive any federal matching funds for this population. The 2000 law also created the Healthy NY program, which provided affordable health insurance options to small business owners and their employees. Under the Affordable Care Act, these programs have rolled their enrollees into expanded Medicaid or subsidized private plans from New York State of Health.23 About 570,000 individuals have enrolled in Medicaid since October 2013 and more than 400,000 have selected private coverage through the marketplace for 2015.24 |

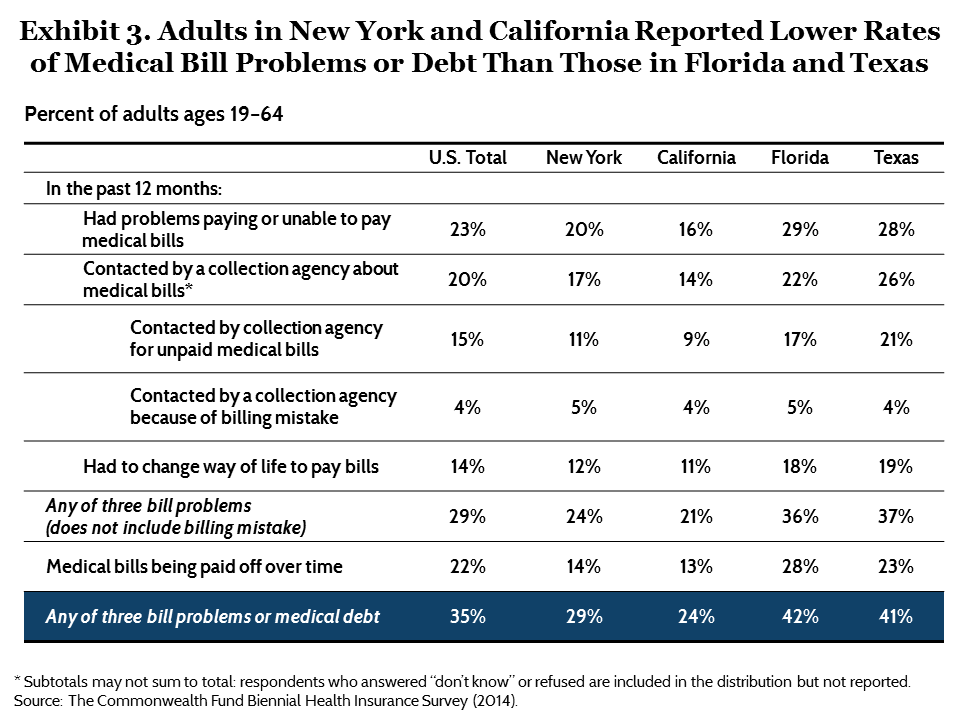

New York and California: Lower Rates of Medical Bill and Debt Problems

There were notable state variations in the percentage of adults reporting medically related financial difficulties in 2014. Fewer adults in New York and California said they had problems paying their medical bills in the past 12 months, or were paying off medical debt, than did adults in Florida and Texas (Exhibit 3). Twenty-nine percent of New Yorkers and 24 percent of Californians said that, in the past 12 months, they had a problem or were unable to pay their medical bills, had been contacted by a collection agency for unpaid medical bills, had to change their way of life to pay medical bills, or were paying off medical bills over time. Rates were much higher in Florida and Texas: more than two of five adults in each state reported at least one of these problems.25 These differences remained after taking into account variations in the demographic compositions of the states’ populations. As with the cost-related access problems, states’ decisions that enhanced access to affordable health insurance coverage both before and after the Affordable Care Act as well as insurance design and cost-sharing likely contribute to differences.

CONCLUSION

The analysis suggests that the health policy decisions made by state leaders matter. Of the four states studied, New York has had the longest history of legislation aimed at enhancing the availability of affordable coverage. California also implemented an early expansion of Medicaid eligibility and, based on federal survey data, both states began achieving declines in their adult uninsured rate earlier than other states.26 Both have taken advantage of opportunities granted by the Affordable Care Act to further expand the reach of coverage and access. Alternatively, Florida and Texas, while experiencing robust enrollment in private plans through the federal health insurance marketplace, have not expanded Medicaid eligibility and have made less headway in reducing their uninsured populations.

While there have been significant declines in the number and share of uninsured adults since the major provisions of the Affordable Care Act went into effect in 2014, coverage gaps are leaving millions uninsured and without access to affordable coverage. An estimated 3.7 million people have fallen into the Medicaid coverage gap in states that have not yet expanded eligibility for Medicaid.27

In addition, the law does not provide access to any new coverage options for unauthorized immigrants. They are ineligible for Medicaid coverage and cannot purchase private plans through the marketplace, either subsidized or unsubsidized. The Congressional Budget Office estimates that by 2020, 30 percent of the remaining uninsured will be unauthorized immigrants, or about 9 million people.28 Another part of the law that is leaving people uninsured is the so-called “family coverage glitch,” which defines affordability—and eligibility for subsidies—based on the cost of individual, rather than family, coverage. Currently, an estimated 2 million to 4 million people are uninsured because of this issue.29

The analysis also indicates that expanded coverage is necessary to improve access to care and reduce medical financial burdens among U.S. families. But the quality and comprehensiveness of coverage across all sources of insurance (marketplace plans, individual plans, employer-provided coverage, and Medicaid), will ultimately determine the degree to which these problems are lessened for U.S. families.

| Methodology The Commonwealth Fund Biennial Health Insurance Survey, 2014, was conducted by Princeton Survey Research Associates International, with a general population sample collected from July 22 to December 14, 2014, and an oversampling of the four largest states, California, Florida, New York, and Texas, collected until December 27, 2014. The survey consisted of 25-minute telephone interviews in either English or Spanish and was conducted among a random, nationally representative sample of adults age 19 and older living in the continental United States. A combination of landline and cellular phone random-digit dial (RDD) samples was used to reach people. The general sample was designed to generalize to the U.S. adult population and to allow separate analyses of responses of low-income households. The majority of this report looks at adults ages 19 to 64 in the four largest states (California sample=758, Florida=659, New York=710, and Texas=714). Statistical results are weighted to correct for the stratified sample design, the overlapping landline and cellular phone sample frames, and disproportionate nonresponse that might bias results. Each state sample is weighted to match population parameters for sex by age, sex by education, age by education, race/ethnicity, population density, household telephone use, household size, and region, using the U.S. Census Bureau’s 2012 American Community Survey data. The resulting weighted general population sample is representative of the approximately 182.8 million U.S. adults ages 19 to 64 and has an overall margin of sampling error of +/– 2 percentage points at the 95 percent confidence level. The California sample has a margin of error of +/– 4.2 percentage points at the 95 percent confidence level; the Florida sample margin of sampling error is +/– 4 percentage points; the New York sample margin of sampling error is +/– 4.1 percentage points; and the Texas sample margin of sampling error is +/– 3.9 percentage points. The landline portion of the survey achieved an 11.5 percent response rate and the cellular phone component achieved an 11.3 percent response rate. |

Notes

1 D. Blumenthal, The Affordable Care Act at Five Years, Invited testimony, Senate Finance Committee, United States Senate, March 19, 2015.

2 S. R. Collins, P. W. Rasmussen, M. M. Doty, and S. Beutel, The Rise in Health Care Coverage and Affordability Since Health Reform Took Effect—Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2014 (New York: The Commonwealth Fund, Jan. 2015).

3 Dollar estimates are based on 2013 federal poverty guidelines, which were used by the government to calculate subsidy levels for 2014 marketplace plans and in the biennial survey to calculate respondents’ federal poverty level.

4 The margin of sampling error for each state was between 3.9 and 4.2 percentage points at the 95 percent level. The estimates from the Biennial Health Insurance Survey, 2014, were similar to those reported by the Centers for Disease Control and Prevention’s National Health Interview Survey (NHIS) for the period of January–September 2014. NHIS reported uninsured rates for 18–64-year-olds in California as 16.8%, in Florida as 23.8%, in New York as 13.5%, and in Texas as 26.8% (http://www.cdc.gov/nchs/nhis/released201503.htm).

5 All reported differences are statistically significant at the p ≤ 0.05 level or better unless otherwise noted.

6 Gallup recently reported state by state uninsured rates for adults age 18 and older and also found significant declines between 2013 and 2014 in California’s uninsured rate. Florida, Texas, and New York saw much more modest declines, but New York had the lowest uninsured rate of the four states at 10.1 percent in 2014. D. Witters, Arkansas, Kentucky Report Sharpest Drops in Uninsured Rate (Washington, D.C.: Gallup, Feb. 24, 2015), http://www.gallup.com/poll/174290/arkansas-kentucky-report-sharpest-drops-uninsured-rate.aspx.

7 This analysis does not draw comparisons between 2012 and 2014 state-level data, as we did not oversample in the the four states in 2012 and the state sample sizes in 2012 were smaller. The confidence intervals around the estimates are wider in 2012 than in 2014, thus potentially underestimating the state-by-state change year over year and the differences between states in 2012 relative to 2014. R. A. Cohen, M. E. Martinez, and B. W. Ward, “Health Insurance Coverage: Early Release of Estimates from the National Health Interview Survey, 2009” (Washington, D.C.: Centers for Disease Control and Prevention, June 2010), http://www.cdc.gov/nchs/data/nhis/earlyrelease/insur201006.pdf; and M. E. Martinez and R. A. Cohen, “Health Insurance Coverage: Early Release of Estimates from the National Health Interview Survey, January–September 2014” (Washington, D.C.: Centers for Disease Control and Prevention, March 2015), http://www.cdc.gov/nchs/data/nhis/earlyrelease/insur201503.pdf.

8 Collins, Rasmussen, Doty et al., Rise in Health Care Coverage, 2015.

9Where Are States Today? Medicaid and CHIP Eligibility Levels for Adults, Children, and Pregnant Women as of January 2015 (Menlo Park, Calif.: Henry J. Kaiser Family Foundation, Feb. 2, 2015), http://kff.org/medicaid/fact-sheet/where-are-states-today-medicaid-and-chip/.

10 There are different eligibility levels for pregnant women in these states. Ibid.

11Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report, ASPE Issue Brief (Washington, D.C.: U.S. Department of Health and Human Services, March 10, 2015), http://aspe.hhs.gov/health/reports/2015/MarketPlaceEnrollment/Mar2015/ib_2015mar_enrollment.pdf.

12 Florida Medicaid overview: https://www.medicaid.gov/state-overviews/stateprofile.html?state=florida; Texas Medicaid overview: https://www.medicaid.gov/state-overviews/stateprofile.html?state=texas.

13 Although differences in immigration status do not fully explain the differences between the states, when respondents who are foreign-born and do not have permanent residency in the U.S. or a green card are excluded from the analysis, the uninsured rates for the states decrease by 2 to 6 percentage points. New York’s uninsured rate decreases from 12% to 9%, California’s rate decreases from 17% to 13%, Florida’s rate decreases from 21% to 19%, and Texas’ rate decreases from 30% to 24%.

14 The reported weighted (unadjusted) estimates are similar to regression-adjusted estimates.

15 Collins, Rasmussen, Doty et al., Rise in Health Care Coverage, 2015.

16 S. R. Collins, P. W. Rasmussen, M. M. Doty, and S. Beutel, Too High a Price: Out-of-Pocket Health Care Costs in the United States (New York: The Commonwealth Fund, Nov. 2014).

17 C. Schoen, D. Radley, and S. R. Collins, State Trends in the Cost of Employer Health Insurance Coverage, 2003–2013 (New York: The Commonwealth Fund, Jan. 2015).

18 S. Dash, K. W. Lucia, K. Keith et al., Implementing the Affordable Care Act: Key Design Decisions for State-Based Exchanges (New York: The Commonwealth Fund, July 2013).

19 E. C. Lytle, D. H. Roby, L. Lucia et al., Promoting Enrollment of Low Income Health Program Participants in Covered California, Policy Note (Los Angeles: UCLA Center for Health Policy Research, April 2013), http://healthpolicy.ucla.edu/programs/health-economics/projects/coverage-initiative/Documents/LIHP_PN3.pdf.

20 Ibid.

21 California Medicaid overview: https://www.medicaid.gov/state-overviews/stateprofile.html?state=california; New York Medicaid overview: http://aspe.hhs.gov/health/reports/2015/MarketPlaceEnrollment/Jan2015/ib_2015jan_enrollment.pdf.

22 New York State Department of Health, “13ADM-03—Medicaid Eligibility Changes Under the Affordable Care Act (ACA) of 2010” (Albany, N.Y.: NYS DOH, Sept. 25, 2013), http://www.health.ny.gov/health_care/medicaid/publications/adm/13adm3.htm.

23 Ibid.

24 New York Medicaid overview: https://www.medicaid.gov/state-overviews/stateprofile.html?state=new-york; Health Insurance Marketplaces 2015 Open Enrollment Period, 2015.

25 The reported weighted (unadjusted) estimates are similar to regression-adjusted estimates.

26 Cohen, Martinez, and Ward, “Health Insurance Coverage: Early Release, 2009,” 2010; and Martinez and Cohen, “Health Insurance Coverage: Early Release, January–September 2014,” 2015.

27 Individuals fall into the Medicaid coverage gap if they are not eligible for Medicaid in their state and have incomes below 100 percent of poverty, the lower limit for subsidized private coverage through the marketplace. See: State Health Facts, “Number of Poor Uninsured Nonelderly Adults in the ACA Coverage Gap” (Menlo Park, Calif.: Henry J. Kaiser Family Foundation, accessed April 8, 2015), http://kff.org/health-reform/state-indicator/number-of-poor-uninsured-nonelderly-adults-in-the-aca-coverage-gap/#.

28 Congressional Budget Office, The Budget and Economic Outlook: 2015 to 2025 (Washington, D.C.: CBO, Jan. 2015), https://www.cbo.gov/sites/default/files/cbofiles/attachments/49892-Outlook2015.pdf.

29 T. Brooks, “Health Policy Brief: The Family Glitch,” Health Affairs, Nov. 10, 2014, http://www.healthaffairs.org/healthpolicybriefs/brief.php?brief_id=129.